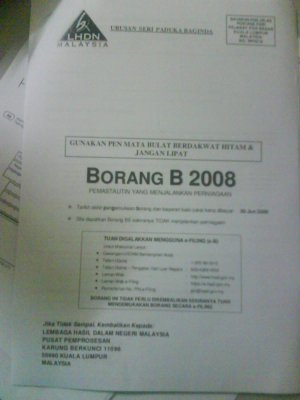

Form P Income tax return for partnership Deadline. 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

Understanding Lhdn Form Ea Form E And Form Cp8d

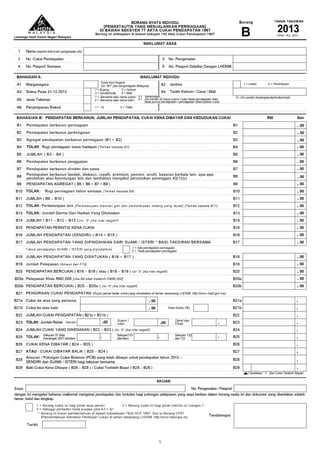

00 N Zakat - Departure levy for umrah travel.

. Identification Passport No. 00-Husband wife. The combination amendment would ratchet down the top corporate and individual income tax rates to 584 but at a slower pace than originally proposed in.

Total rebate - Self. B23b 00Tax on the balance. Key in the employees income tax number in this item.

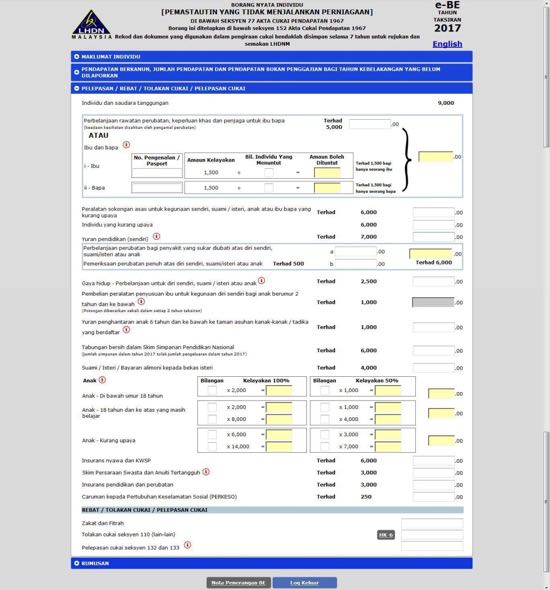

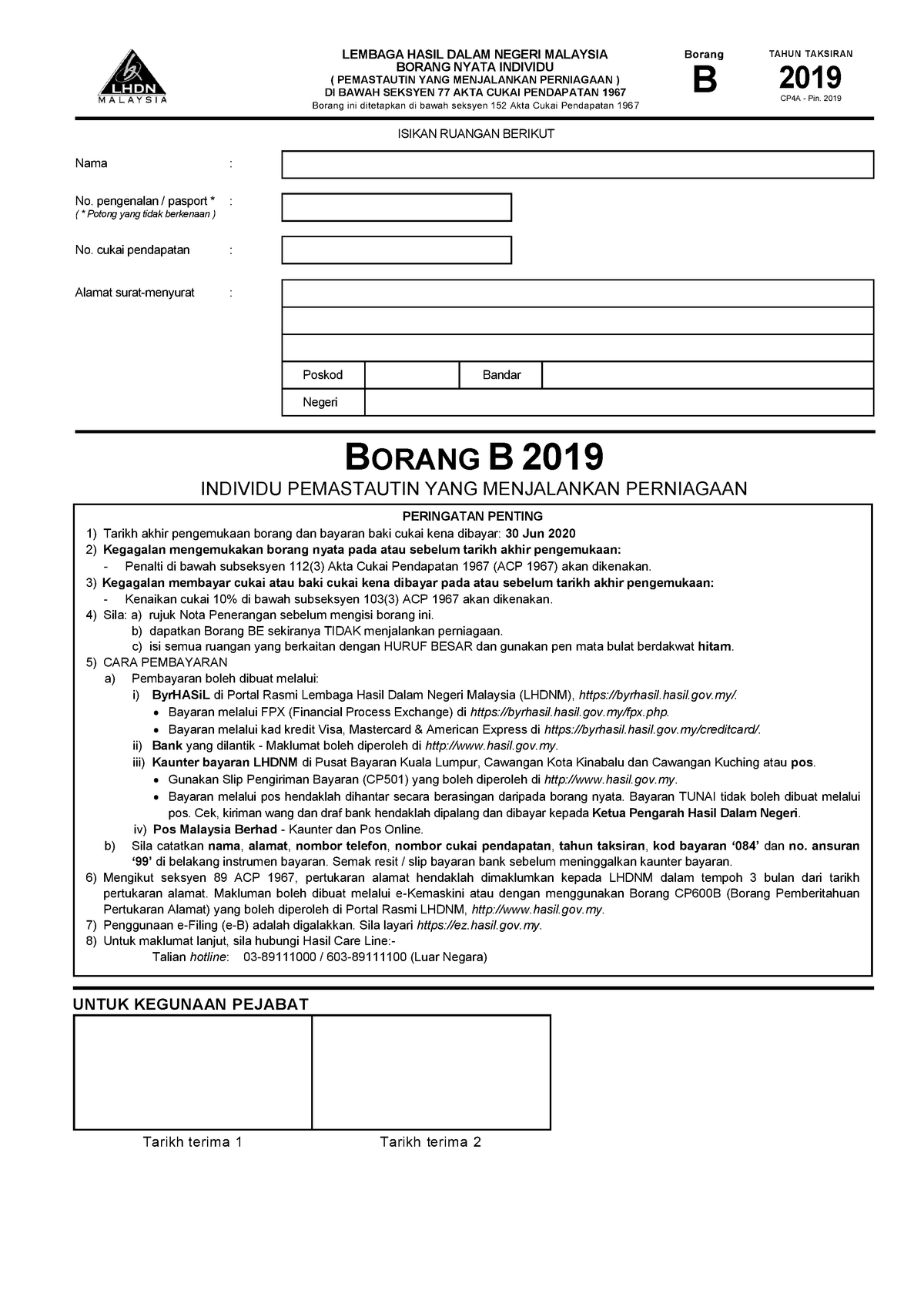

B23 INCOME TAX COMPUTATION Refer to the tax rate schedule provided at the LHDNM Official Portal httpswwwhasilgovmy B23a Tax on the first. Total income tax exemptions and reliefs chargeabletaxable income. 1 Tarikh akhir pengemukaan borang dan bayaran cukai atau baki cukai kena dibayar.

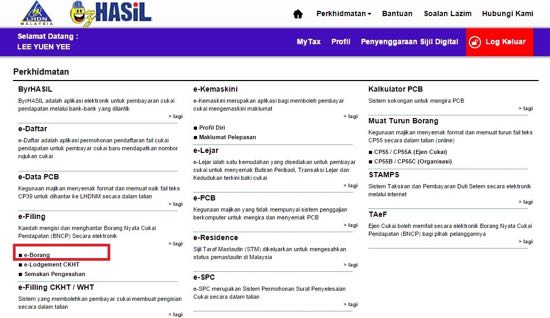

Setelah berjaya log masuk ke sistem ezHASiL skrin Perkhidmatan akan dipaparkan. 请问我要怎么知道我已经Register Income Tax 呢 我有收到cukai pendapatan的来信但是我要在login的时候却忘记密码当我按Forgot Password再输入我的IC号码却显示Digital Certificate does not exist所以代表说我没有注册过吗. For the full list of tax reliefs you can claim for in YA 2021 and an explanation of each relief you can refer to our post on everything you should be claiming for here or to the infographic below.

Enter the full name of the employee as per his or her identity cardpassport. HK-6 Tax Deduction under Section 110 Others 46 HK-7 Not Applicable to Form B Not Enclosed - HK-8 Income from Countries which have Avoidance of Double Taxation 46 Agreement with Malaysia and Claim for Section 132 Tax Relief HK-9 Income from Countries Without Avoidance of Double Taxation 46. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time.

A single filer making 20 an hour at a full-time job would get only. Your tax rate is calculated based on your taxable income. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30.

30 Jun 2021 2 Pengemukaan secara e-Filing e-B boleh dibuat melalui httpsmytaxhasilgovmy. Klik pada pautan e-Borang di bawah menu e-Filing. Sistem ezHASiL akan memaparkan skrin eBorang seperti di bawah.

Atau c Borang BE individu yang tidak menjalankan perniagaan. Atau b Borang BT pekerja berpengetahuan atau pekerja berkepakaran yang telah diluluskan oleh Menteri. Cara Isi Borang e-Filing Online.

Then each subsequent Borang E filed for the rest of the employees should be numbered as 2 3 etc. Income tax return for individual who only received employment income Deadline. B21b Tax on the balance.

IRB Branch-E-PART TAXPAYERS PERSONAL PARTICULARS REFER NOTE SELF Male Borang yang ditetapkan di bawah Seksyen 152 Akta Cukai Pendapatan 1967 Form prescribed under Section 152 of the Income Tax Act 1967 CP 4 - Pin. Coming back to the tax exemptions and reliefs these are all the ones that were announced by the. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Once youve logged in under the e-filing section click on e-Borang and that will take you to your tax e-filing form. Form B - income assessed under Section 4 a - 4 f of the ITA 1967 and be completed by individual residents who have business income sole proprietorship or partnership. Form B Income tax return for individual with business income income other than employment income Deadline.

Choose your corresponding income tax form ie. Per LHDNs website these are the tax rates for the 2021 tax year. B22 TOTAL INCOME TAX B21a B21b B22.

30062022 15072022 for e-filing 6. Form BE income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business. Contribute to listianiana8diraya development by creating an account on GitHub.

Tarikh akhir hantar borang e-Filling cukai pendapatan untuk taksiran tahun 2021 boleh dirujuk pada maklumat Tarikh Akhir Hantar e-filling 2022. 30th June 2021 is the final date for submission of Form B Year Assessment 2020 and the payment of income tax for individuals who earn business income. Employers Income Tax File No.

Paying income tax due accordingly may avoiding you from being charged tax increase court action and. 3 Kegagalan mengemukakan borang nyata pada atau sebelum tarikh akhir pengemukaan. Weve already explained how tax relief can reduce your chargeable income and thus your tax rate and tax amount above.

Can I declare my business income if I receive a Form BE. 00 B23 - Departure levy for umrah travel. Accounting period basis period for a Labuan entity is 01022020 31012021.

00 At rate B21b. You must be wondering how to start filing income tax for the. At rate B23b.

30042022 15052022 for e-filing 5. Ad Choose from the Top Recommended Tax Problem Assistance Companies on Our Website Today. Buku Panduan Borang B Ruang Perkara Sistem Taksir Sendiri Keterangan Helaian Kerja Lampiran A3 Status Pada 31-12-2013 Isikan 1 untuk bujang 2 untuk kahwin 3 untuk jandaduda 4 untuk mati.

Income Tax File No. 你好请问如过2019年上班年都是打工的下半年开始做 Grab driver那是否需要换成 Borang B可是之前的 income tax number 都是 SG的要怎样换呢. Ad Easy online tax preparation software.

Income other than business. Business income should be declared in the Form B. E-BE if you dont have business income and choose the assessment year tahun taksiran 2015.

Ad Top-rated pros for any project. Pembayar cukai boleh mengemukakan Borang Nyata Cukai Pendapatan BNCP tahun taksiran semasa mereka melalui e-Filing bagi borang E BE B BT PM MT dan TF. Pilih jenis borang pada skrin e-Borang dan klik tahun taksiran yang berkaitan.

Total 00rebate - Self. 2003STTS Female SAMPLE TAHUN TAKSIRAN. Mail them in separate envelopes to the.

Hak Cipta Terpelihara 2018 Lembaga Hasil Dalam Negeri Malaysia Hak Cipta Terpelihara 2018 Lembaga Hasil Dalam Negeri Malaysia. B24 TOTAL INCOME TAX B23a B23b B24. A Borang B individu yang menjalankan perniagaan.

Form B income assessed under Section 4 a 4 f of the ITA 1967 and be completed by individual residents who have business income sole proprietorship or partnership. So the more taxable income you earn the higher the tax youll be paying. Untuk keterangan lanjut sila rujuk PUA 3442010 berkaitan pekerja berpengetahuan dan PU.

- - A4 Tarikh Kahwin CeraiMati Isikan tarikh kahwin jika berkahwin dalam tahun semasa atau tarikh cerai jika berpisah mengikut. Ad E-File Your Taxes for Free. B21 INCOME TAX COMPUTATION Refer to the tax rate schedule provided at the LHDNM Official Portal httpwwwhasilgovmy B21a Tax on the first.

As a result she said a married couple filing jointly and making 80000 a year would get no income tax break under LB 873.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Business Income Tax Malaysia Deadlines For 2021

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

Trainees2013 Borang B Tax Otosection

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

Tarikh Akhir E Filing 2021 Bila Mula Isi 2022 Buka Tutup

My First Time With Income Tax E Filing For Lhdn Namran Hussin

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Borang B 2019 1 Tax Borang B 2019 Individu Pemastautin Yang Menjalankan Perniagaan Tarikh Terima Studocu

Borang B Cukai Pendapatan Your Tax We Care